43+ how much mortgage interest can be deducted

You can deduct the interest on up to 750000 of mortgage debt or up to 375000 if youre married and filing separately. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

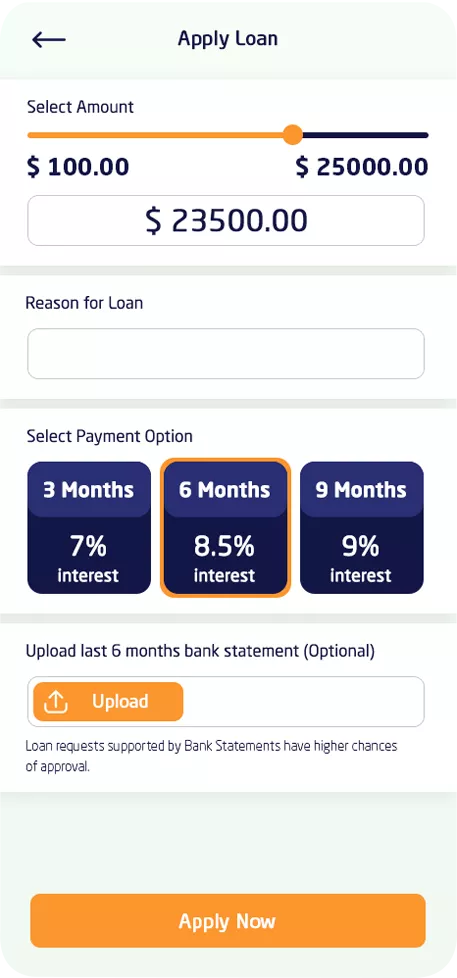

Secure Loan Lending App Development Company Inventcolabs

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Complete Edit or Print Tax Forms Instantly.

Web The deduction is reduced by 10 percent for each additional 1000 of adjusted gross household income phasing out after 109000. Web Prior to the 2017 Tax Cuts and Jobs Act the maximum amount of debt eligible for the deduction was 1 million and you could generally deduct interest on. Homeowners who bought houses before December 16 2017 can.

If you took out your home loan before. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web How Much Mortgage Interest Can I Deduct.

See If You Qualify To File 100 Free w Expert Help. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Ad Access Tax Forms.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. However higher limitations 1 million 500000 if married. NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Register and Subscribe Now to Work on Pub 936 More Fillable Forms. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Married individuals filing separate returns. 750000 if the loan was finalized.

Homeowners can deduct interest expenses on up to 750000 of mortgage debt from their income taxes though when they itemize these. Get Live Help From Tax Experts Plus A Final Review Before You File - All Free. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to. Ad For Simple Returns Only. Web If your home was purchased before Dec.

Web Most homeowners can deduct all of their mortgage interest. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year.

16 2017 and later. Web Interest expense.

Cancel Student Debt Balconyplant Twitter

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Home Mortgage Interest Deduction Lendingtree

Pdf Income Tax And Vat Issues Concerning Leases After Ifrs 16 Convergence In Indonesia

Home Mortgage Interest Deduction Calculator

Race And Housing Series Mortgage Interest Deduction

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Maximum Mortgage Tax Deduction Benefit Depends On Income

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Business Succession Planning And Exit Strategies For The Closely Held

The Home Mortgage Interest Deduction Lendingtree

Tbank Annual Report 2007 Eng By Shareinvestor Thailand Issuu

Secure Loan Lending App Development Company Inventcolabs